The Future of Luxury Retail: Why Video Consultations Are Inevitable

In 2019, if you told luxury retailers they’d soon be conducting half their sales via video, most would have laughed.

By 2020, when pandemic forced the experiment, they stopped laughing.

By 2025, early adopters aren’t asking if video consultations work—they’re expanding their programs and wondering why they waited so long.

This article isn’t about predicting the future. It’s about recognizing what’s already happening—and why luxury retailers who don’t adapt will be left behind.

The Unstoppable Forces Reshaping Luxury Retail

1. The Death of Geographic Advantage

For decades, luxury retail lived on location. Open a boutique on Madison Avenue, Worth Avenue, or Rodeo Drive, and you had access to affluent customers.

That advantage is dying.

Why:

- Customers research online regardless of where they buy

- Brand discovery happens digitally, not by walking past storefronts

- Affluent customers increasingly live in secondary markets (Sun Belt cities, suburban communities)

- International luxury buyers don’t need to visit New York, Paris, or London anymore

The Data:

- 87% of luxury purchases now start with online research (Bain & Company, 2024)

- Only 35% of luxury buyers live in traditional luxury retail markets

- Secondary markets (Austin, Nashville, Scottsdale) grew luxury spend by 42% (2020-2024)

What This Means: If your business model depends on foot traffic from a specific location, you’re vulnerable. Video consultations let you serve customers anywhere—removing geographic limitations entirely.

Real Example: Manhattan luxury jeweler now does 40% of business with customers who’ve never visited New York. Video consultations opened markets from Seattle to Miami to Singapore.

2. The Generational Shift

Millennials (now 29-44) and Gen Z (now 13-28) are becoming luxury customers. And they shop completely differently than Boomers and Gen X.

Millennial/Gen Z Luxury Buyer Preferences:

- Digital-first discovery (Instagram, TikTok, YouTube)

- Value convenience over tradition

- Prefer video calls to phone calls (by 3:1 margin)

- Comfortable making high-value purchases online if properly served

- Expect personalization and expertise

- Want experience, not just product

Critical Insight: They’re not avoiding luxury—they’re rejecting how luxury has traditionally been sold. Stuffy boutiques. Appointment-required policies. Geographic limitations. Sales tactics.

Video consultations solve all of this: ✓ Access from anywhere ✓ Schedule flexibility ✓ Digital-native format (video) ✓ Personal attention without pretension ✓ Expert guidance when needed ✓ Pressure-free environment

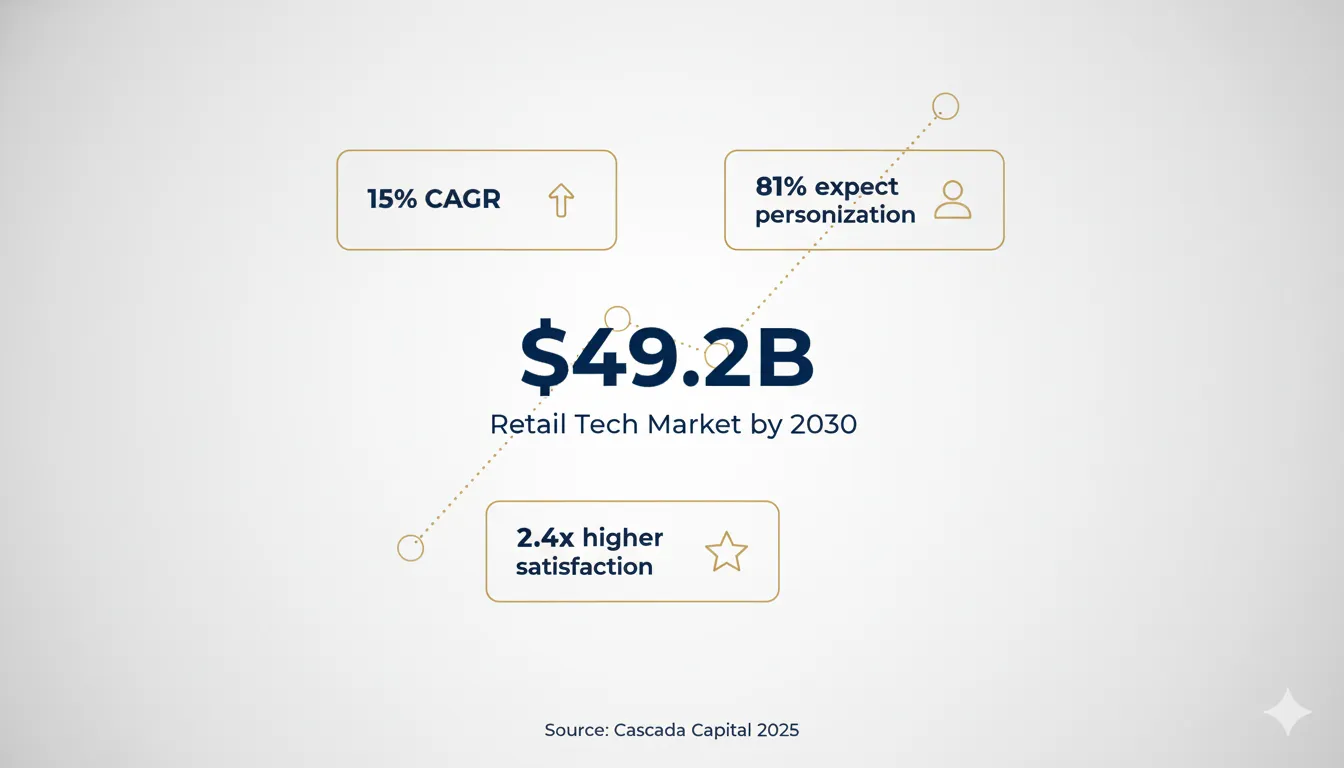

The Stakes: Millennials will spend $1.4 trillion annually on luxury by 2030 (Bain). Gen Z adds another $360 billion by 2035. If you don’t meet them where they are (digital, video-enabled, convenient), you lose this entire generation.

Real Example: Traditional jeweler attracting 60% Millennial/Gen Z customers through video consultations. Their in-store customer base skews 65% Boomer/Gen X. The future is buying differently.

3. The Economics of Physical Retail Are Broken

Let’s talk about the elephant in the room: physical retail is getting more expensive while becoming less profitable.

The Math:

- Prime retail real estate: $200-$1,000+ per square foot annually

- Full-time sales associate: $40,000-$80,000 + benefits

- Build-out costs: $100-$500 per square foot

- Utilities, insurance, security, maintenance: 10-15% of revenue

The Reality: Many luxury retailers are profitable despite physical stores, not because of them. Stores are brand marketing, not efficient sales channels.

Video Consultation Economics:

- Platform costs: $200-$800/month

- Equipment: $2,000-$5,000 (one-time)

- Same specialists (but more productive)

- No real estate, utilities, or build-out

Per-Hour Productivity:

- In-store specialist: 2-3 consultations per day = 0.25-0.375 per hour

- Video specialist: 4-6 consultations per day = 0.5-0.75 per hour

ROI Comparison: Physical store: 10-25% operating margin (retail averages) Video consultations: 60-80% operating margin (platform costs only)

The Trend: High-end retailers are reducing physical footprint while expanding video. Not eliminating stores (brand presence still matters), but fewer, smaller, appointment-only locations.

Real Example: Multi-location jeweler considering closing smallest store (lease expiring) and redirecting those customers to video. Annual savings: $180,000. Revenue impact: minimal (customers already prefer video).

4. Customer Expectations Have Permanently Changed

Pre-2020: “Can I visit your store?” 2020-2021: “Can I do this remotely?” 2022-2025: “Wait, I have to come in person?”

The pandemic didn’t create video consultations—but it normalized them. Customers who initially used video out of necessity discovered they prefer it.

What Customers Now Expect:

- Ability to shop from home

- Appointment booking online

- Video option for consultation

- Expert available when convenient for customer

- Seamless digital + physical experience

Luxury Has Caught Up:

- Hotels: Virtual concierge

- Real estate: Virtual showings

- Healthcare: Telemedicine

- Financial services: Video advisory

Luxury retail was late to this shift—but is catching up fast.

The Point of No Return: Once customers experience convenient video consultations, they don’t go backward. It’s like online shopping in the 2000s—initial resistance, then adoption, then expectation.

We’re now in the “expectation” phase.

Real Example: Jeweler reports 78% of video consultation customers say they’d choose video again over in-person for future purchases—even customers who live locally.

5. Technology Has Reached the Tipping Point

Early video selling attempts (2010-2015) failed because technology wasn’t good enough. Choppy video. Poor audio. Clunky checkout. Limited to desktop.

That’s no longer true.

Technology Advances:

- 4K video is standard (better than human eye in some cases)

- 5G enables high-quality mobile streaming

- Browser-based (no download required)

- Macro cameras show microscopic detail

- Professional lighting is affordable

- AI assists with scheduling, follow-up, analytics

Critical Mass: Everyone now has high-speed internet and HD cameras (phones). Both seller and buyer have the technology already.

Seamless Integration: Modern platforms (like Immerss) integrate video + commerce + CRM in one interface. Customer never leaves video to purchase. Specialist has all customer data during consultation.

The Result: Video consultations now deliver experiences equal or superior to in-person for many luxury categories.

Real Example: Watch dealer: “The 4K macro camera shows movement details customers couldn’t see with naked eye in-person. Video is actually better for demonstrating watch authenticity and craftsmanship.”

The Inevitable Future: Three Retail Models

By 2030, luxury retail will operate on three models:

Model 1: Flagship Experience Stores

Purpose: Brand immersion, not sales optimization Format: Spectacular physical locations in premium cities Target: Brand building, VIP experiences, press coverage Sales: Minimal (maybe 10-20% of revenue) Example: Tiffany Fifth Avenue, Cartier Mansion

Who Uses This: Ultra-luxury brands with massive marketing budgets. Stores are advertisements, not sales channels.

Model 2: Hybrid Consultation Centers

Purpose: Blend physical + digital Format: Smaller locations, appointment-only, video-enabled Target: Local VIPs in-person, everyone else video Sales: 50/50 in-person and video Example: High-end jewelers, watch specialists, designer boutiques

Who Uses This: Established luxury retailers transitioning from traditional retail. Maintains physical presence but extends reach through video.

Model 3: Digital-First with Consultation

Purpose: Maximum efficiency and reach Format: No physical stores, all video consultations Target: Geographically dispersed customers Sales: 90%+ video consultations Example: DTC luxury brands, independent dealers, specialists

Who Uses This: New luxury retailers and independent specialists. No real estate overhead, global reach from day one.

The Death: Traditional walk-in retail with full inventory on display in multiple locations. This model is dying in luxury because:

- Too expensive (real estate, staff, inventory)

- Too geographically limiting

- Too inconvenient for customers

- Lower productivity than video

What This Means by Category

Fine Jewelry (Engagement Rings, High-End)

Timeline to Video Dominance: 2027-2029

Why:

- Visual products benefit from video showcasing

- Expertise critical (education drives sales)

- High value justifies consultation time

- Customers willing to buy sight-unseen after proper consultation

Current Adoption: ~25% of high-end jewelers offer video 2030 Prediction: 80%+ offer video, 40-60% of sales via video

Luxury Watches

Timeline: Already happening, accelerating 2025-2028

Why:

- Collectors are global

- Authentication requires expertise

- Vintage/rare pieces are one-of-one

- Video reaches international buyers efficiently

Current Adoption: ~40% of independent dealers use video 2030 Prediction: 90%+ independent dealers video-primary

High-End Fashion

Timeline: 2026-2030

Why:

- Personal styling is differentiator

- Try-before-you-buy can still work with video (show on model, ship multiple sizes)

- Younger customers prefer video shopping

Challenge: Fit and feel are harder to convey than jewelry/watches. But technology (AR try-on, better cameras) is solving this.

Current Adoption: ~15% of luxury fashion uses video 2030 Prediction: 50-60% offer video consultations

Luxury Home Goods (Furniture, Art, Design)

Timeline: 2027-2032

Why:

- High value per item

- Design consultation adds value

- Customers want to see in context

Challenge: Physical scale harder to convey. But AR room visualization technology is improving rapidly.

Current Adoption: ~10% 2030 Prediction: 40-50% for high-end designers

The Technology Roadmap: What’s Coming

Near-Term (2025-2027)

AI-Powered Personalization: Real-time product recommendations during consultation based on customer’s stated preferences and behavioral signals.

Augmented Reality Try-On: Customer holds phone up to wrist, sees watch on their wrist in real-time during video call. Same for jewelry, glasses, etc.

Automatic Translation: Real-time translation during video consultations. Specialist speaks English, customer hears Spanish—and vice versa. Enables global selling.

Enhanced Analytics: AI analyzes consultations, identifies what worked, coaches specialists automatically. “You spent 10 minutes on this objection—here’s a better way to address it next time.”

Medium-Term (2027-2030)

Haptic Feedback: Customer receives small device that simulates texture, weight of jewelry during video consultation. “Feel” diamond’s coldness, gold’s weight.

3D Holographic Display: Instead of flat video, products appear as 3D holograms customer can rotate and examine from all angles.

Virtual Showrooms: VR headset shows customer inside your boutique virtually. Walk around, examine products, with specialist guiding remotely.

Blockchain Authentication: During video consultation, specialist scans product. Blockchain verification happens live, proving authenticity. Certificate goes to customer’s digital wallet.

Long-Term (2030+)

Full VR Consultations: Customer and specialist both in VR, “sitting” across table from each other in virtual boutique. Feels like in-person while being completely remote.

AI Co-Pilots: AI assists specialist during consultation, surfacing information, suggesting products, handling admin—letting specialist focus on relationship.

Biometric Feedback: Camera analyzes customer’s microexpressions during consultation. AI alerts specialist: “Customer seems uncertain about price” or “High interest in this piece.”

Instant Custom Manufacturing: Customer designs custom piece during video consultation. AI renders it in real-time. Customer approves. Manufacturing begins that day. Piece arrives in 2 weeks.

The Competitive Shakeout

Not every luxury retailer will survive this transition. Here’s who wins and who loses:

Winners:

1. Early Adopters Retailers implementing video consultations now (2024-2026) will own their categories by 2030. They’ll have:

- Proven programs with refined processes

- Trained specialists with video expertise

- Customer bases familiar with video format

- Market share captured from non-video competitors

2. Digital-Native Luxury DTC brands launching with video-first models skip physical retail entirely. Lower costs, global reach from day one, no legacy infrastructure to unwind.

3. Specialists and Experts Independent dealers, specialists, experts—people with knowledge and small inventory—thrive. No need for expensive storefronts. Just expertise + video = global business.

4. Tech-Savvy Operators Retailers who embrace technology, measure everything, optimize continuously—they’ll drive better results from video consultations through data-driven improvement.

Losers:

1. Location-Dependent Retailers If your entire business model is “we’re on this street,” you’re in trouble. Location advantage disappears when video consultations open geography.

2. Inventory-First, Expertise-Second Retailers who compete on “we have everything in stock” lose to specialists who curate and educate via video. Customers care more about guidance than breadth.

3. Resistant to Change “Our customers will never buy via video.” Those customers might not—but they’re aging. Next generation will. Retailers refusing to adapt will age out with their customer base.

4. Mediocre Service Average service was fine when customers had limited options. Video consultations make expertise accessible globally. Mediocre service now competes with world-class specialists anywhere.

What You Should Do Now

Luxury retailers have a window—roughly 2025-2027—to implement video consultations and build competitive advantage.

After that, it becomes table stakes, not differentiator.

If You’re a Traditional Luxury Retailer:

Year 1 (2025):

- Launch video consultation pilot program

- Start with 1-2 specialists, 1 product category

- Test with existing customers first

- Measure, learn, refine

Year 2 (2026):

- Expand to full team and all categories

- Market video consultations prominently

- Build video into customer journey

- Consider reducing physical footprint if leases allow

Year 3 (2027):

- Video consultations are primary channel

- Physical stores become appointment-only or flagship-only

- Majority of sales via video (50-70%)

- New hires trained on video from day one

If You’re Launching a New Luxury Brand:

Start Video-First:

- No physical locations initially

- Launch with video consultations as primary sales channel

- Use pop-ups and events for brand awareness

- Consider flagship later if/when it makes strategic sense

The Advantage: No legacy infrastructure, no lease obligations, no “this is how we’ve always done it.” Start with the model that will dominate 2030.

If You’re an Independent Specialist:

Go Video-Only:

- You don’t need a showroom anymore

- Build global business from home office

- Reach collectors/customers anywhere

- Compete with largest retailers on expertise, not inventory

The Opportunity: Technology has leveled the playing field. The best specialist in Des Moines can now serve customers in Dubai, Tokyo, São Paulo. Geography no longer limits your business.

The Bottom Line: Adapt or Die

This isn’t hyperbole. We’ve seen this movie before:

Photography Retail (2000s): Digital cameras arrived. Kodak said “customers want film.” Kodak filed bankruptcy in 2012. Canon, Nikon adapted. Fujifilm pivoted entirely. Winners adapted, losers disappeared.

Book Retail (2000s-2010s): Amazon arrived with online book sales. Borders said “customers want stores.” Borders liquidated in 2011. Barnes & Noble adapted with Nook and cafés—survived. Independent bookstores that offered unique value survived. Winners adapted.

Video Rental (2000s-2010s): Netflix launched streaming. Blockbuster said “customers want stores.” Blockbuster liquidated in 2013. Redbox adapted with kiosks—survived briefly. Winners adapted or died.

Luxury Retail (2020s-2030s): Video consultations enable remote personal service. Retailers who say “our customers want in-person” will face the same fate.

The pattern is clear: When technology enables better customer experience at lower cost, resistance is futile. You either adapt or become case study in business school.

Ready to Lead the Future?

Immerss is building the infrastructure for this future. Purpose-built for luxury retail, designed for personal consultation, optimized for conversion.

Our Vision: Every luxury retailer, regardless of size or location, should be able to serve customers globally through personal video consultations. Technology should enhance—not replace—human expertise and relationships.

Schedule a demo to see how video consultations achieve 40-70% conversion rates and discover your roadmap to 2030.

The future is being built now. You can lead it—or be left behind.

The choice is yours.

Article by Immerss Strategic Insights Team Research sources: Bain & Company, McKinsey, Coresight Research, industry interviews Published November 2025