Executive Summary

The retail industry faces a structural staffing crisis that threatens long-term viability for businesses clinging to traditional labor models. A recent Reddit discussion on r/retail encapsulated what industry data confirms: understaffing creates a vicious cycle of burnout, turnover, service degradation, and revenue loss that far exceeds any short-term payroll savings.

This analysis examines the current state of retail staffing, quantifies the true cost of understaffing, identifies emerging solutions, and provides strategic recommendations for retail leaders navigating this challenge.

Key Findings:

- Retail turnover exceeds 60% annually, with understaffed stores experiencing 80%+ turnover rates

- The true cost of each turnover event ranges from $3,000 to $25,000 depending on role

- Understaffed stores experience 40-60% higher shrinkage rates than adequately staffed competitors

- Customer satisfaction drops 18-25% in understaffed environments, correlating with 12-15% revenue decline

- Technology-augmented staffing models show 25-40% improvement in service capacity without proportional labor cost increases

Current State: The Retail Staffing Landscape

Industry-Wide Turnover Crisis

The retail sector has historically struggled with employee retention, but post-pandemic dynamics have intensified the challenge. Current data reveals concerning trends:

Turnover Rates by Retail Segment:

| Segment | Average Turnover | Understaffed Stores | Impact on Service |

|---|---|---|---|

| Quick Service Restaurants | 130% | 160%+ | Severe wait times |

| Grocery | 65% | 85% | Checkout delays, stock-outs |

| Apparel | 60% | 80% | Reduced sales assistance |

| Electronics | 55% | 75% | Knowledge gaps, lost sales |

| Department Stores | 58% | 78% | Service degradation across departments |

| Specialty Retail | 52% | 70% | Expertise scarcity |

Root Causes of Elevated Turnover:

- Workload intensification (cited by 67% of departing retail workers)

- Insufficient compensation (58%)

- Schedule instability (49%)

- Limited advancement opportunities (44%)

- Poor management relationships (41%)

- Physical and emotional exhaustion (38%)

Understaffing directly drives factors 1, 5, and 6 — creating a feedback loop where cost-cutting accelerates the very problem it attempts to solve.

The Economics of Understaffing

True Cost Per Turnover Event

Most retail executives significantly underestimate turnover costs because they only measure direct expenses. Comprehensive analysis reveals:

Direct Costs:

- Recruiting: $500-2,000 per hire

- Background checks and screening: $100-300

- Training time: 40-80 hours at trainer and trainee wages

- Administrative processing: $200-500

- Uniforms and equipment: $100-400

Indirect Costs:

- Productivity loss during vacancy: 2-4 weeks of reduced output

- Learning curve inefficiency: 8-12 weeks at 60-80% productivity

- Manager time for hiring/supervision: 15-30 hours per new hire

- Team disruption and morale impact: difficult to quantify but significant

- Customer relationship discontinuity: particularly impactful in relationship-driven retail

Aggregate Cost by Role:

| Position | Direct Costs | Indirect Costs | Total Cost |

|---|---|---|---|

| Entry-level associate | $1,500 | $1,500-3,000 | $3,000-4,500 |

| Experienced associate | $2,000 | $3,000-5,000 | $5,000-7,000 |

| Specialist/Senior | $3,000 | $5,000-8,000 | $8,000-11,000 |

| Department lead | $4,000 | $8,000-12,000 | $12,000-16,000 |

| Assistant manager | $5,000 | $12,000-20,000 | $17,000-25,000 |

A retailer with 100 employees and 70% turnover faces $350,000-$500,000 in annual turnover costs — often exceeding the amount “saved” through understaffing.

Revenue Impact of Service Degradation

Understaffing doesn’t just increase costs — it directly reduces revenue through multiple mechanisms:

Conversion Rate Impact:

- Customers who wait >2 minutes for assistance convert at 15-25% lower rates

- Customers who receive no assistance convert at 30-50% lower rates than assisted customers

- Each percentage point of conversion represents significant revenue (e.g., 1% on $10M in traffic = $100K)

Transaction Value Impact:

- Cross-sell and upsell rates drop 40-60% in understaffed environments

- Average transaction value declines 8-15%

- Impulse purchase rates fall as browsing customers lack engagement

Customer Lifetime Value Impact:

- Customer satisfaction scores drop 18-25% in understaffed stores

- Each 1-point satisfaction decline correlates with 3-5% reduction in repeat visits

- Negative experience word-of-mouth affects 9-15 potential customers per incident

Shrinkage Impact:

- Industry average shrinkage: 1.4% of revenue

- Understaffed stores: 2.0-2.6% of revenue

- For a $20M store, difference = $120,000-$240,000 in annual losses

Sector Analysis: Who’s Winning and Losing

Retailers Getting It Right

Some retailers have broken the understaffing cycle by reimagining service delivery:

Best Buy: After significant struggles, Best Buy invested in employee development, competitive compensation, and technology-enabled service. Result: turnover reduction from 80%+ to below 40%, customer satisfaction improvement, and revenue stabilization despite industry headwinds.

Costco: Consistently maintains higher staffing levels and wages than competitors. Result: turnover rate approximately 1/3 of industry average, customer loyalty metrics among highest in retail, profitable growth while competitors struggle.

Apple Retail: Heavy investment in employee selection, training, and compensation combined with technology-enabled service. Result: highest revenue per square foot in retail, employee tenure significantly above industry average.

Retailers Struggling

Conversely, retailers who’ve prioritized labor cost reduction over service quality have faced consequences:

Multiple department store chains have reported declining comparable sales despite traffic recovery, correlating with reduced staffing levels and declining customer satisfaction scores. The pattern repeats: cost cuts → service decline → revenue decline → more cost cuts.

Emerging Solutions: Technology and Service Model Innovation

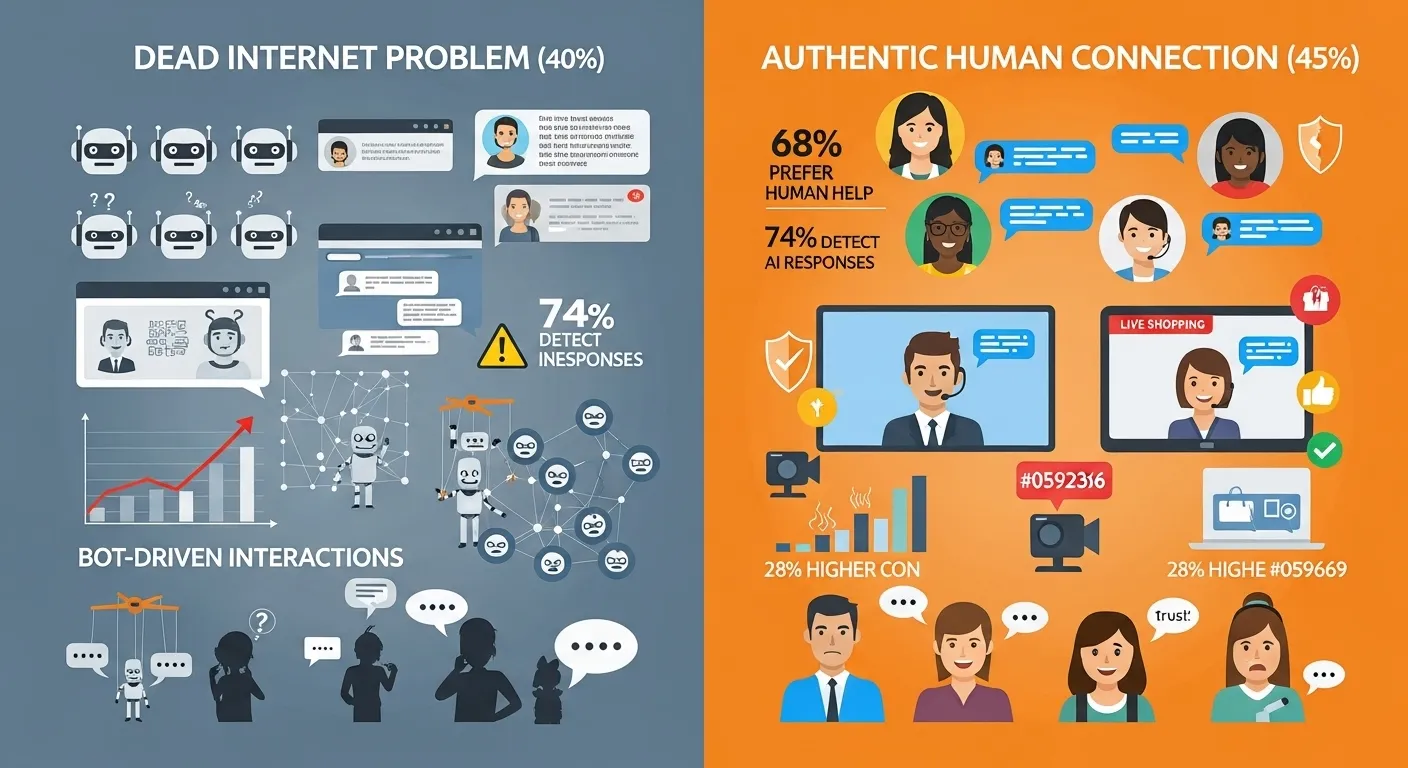

The Rise of Human-AI Service Partnerships

The most promising development in addressing retail staffing challenges is the emergence of human-AI partnership models that extend staff capabilities without proportional cost increases.

Key Technology Categories:

Conversational AI and Chatbots

- Function: Handle routine inquiries, provide instant responses, qualify needs before human handoff

- Capacity impact: Can handle 40-70% of customer inquiries without human involvement

- Deployment: Website, mobile app, in-store kiosks

- Maturity: High — proven technology with established ROI

Live Video Commerce

- Function: Enable human experts to serve multiple customers simultaneously through live video shopping experiences

- Capacity impact: One expert can engage 10-50+ customers in a single session

- Deployment: Website, social media, appointment scheduling

- Maturity: Growing rapidly — platforms like Immerss enabling mainstream adoption

AI-Assisted Associates

- Function: Provide real-time product information, customer history, and recommendations to human staff

- Capacity impact: Reduce information lookup time by 60-80%, enable less experienced staff to perform at expert levels

- Deployment: Mobile devices, smart displays, earpiece assistants

- Maturity: Medium — rapidly improving with generative AI advances

Self-Service and Automation

- Function: Enable customers to complete routine transactions without staff assistance

- Capacity impact: Can handle 50-80% of checkout transactions, reducing staffing needs

- Deployment: Self-checkout kiosks, mobile checkout, automated returns

- Maturity: High — widespread adoption with established best practices

ROI Analysis: Technology Investment vs. Additional Staffing

Scenario: Mid-sized specialty retailer seeking to improve service availability

Option A: Additional Staffing (Traditional Approach)

- 5 additional full-time associates at $35,000 fully loaded

- Annual cost: $175,000

- Capacity increase: ~40 additional service hours per day

- Service coverage improvement: 25-30%

Option B: Technology-Augmented Model

- Conversational AI implementation: $40,000 year 1, $20,000 ongoing

- Live commerce platform: $30,000 year 1, $15,000 ongoing

- AI-assisted associate tools: $25,000 year 1, $12,000 ongoing

- 2 additional associates for high-value interactions: $70,000

- Total year 1: $165,000; ongoing: $117,000

- Capacity increase: 24/7 digital availability + 16 additional human service hours

- Service coverage improvement: 60-80%

Option B delivers:

- Superior service coverage (60-80% vs. 25-30% improvement)

- Lower ongoing costs ($117K vs. $175K annually)

- 24/7 availability impossible with staffing alone

- Scalability without proportional cost increase

- Data capture for continuous optimization

Case Studies: Technology-Enabled Service Transformation

Case Study 1: Jewelry Retailer A mid-market jewelry brand implemented live video shopping consultations alongside their existing store network.

Results:

- Online conversion rate increased 340%

- Average order value 28% higher for video-assisted purchases

- Return rate 45% lower (better fit through consultation)

- Service capacity increased without additional floor staff

- Peak-period customer wait times eliminated through appointment booking

Case Study 2: Electronics Retailer A regional electronics chain deployed AI-assisted associate tools and conversational AI for routine inquiries.

Results:

- Staff productivity (revenue per labor hour) improved 32%

- Customer satisfaction scores increased 18 points

- New hire ramp time reduced from 8 weeks to 3 weeks

- Turnover rate decreased 22% (reduced frustration from knowledge gaps)

- Shrinkage reduced 15% (more staff attention available for loss prevention)

Case Study 3: Apparel Brand A fashion retailer implemented AR try-on and conversational styling assistance to augment limited store staff.

Results:

- Customer self-service increased 55%

- Staff freed to focus on high-consideration purchases

- Conversion rate improved 12% despite 15% reduction in floor headcount

- Customer satisfaction maintained (no decline despite fewer staff)

- Labor cost as percentage of revenue decreased 2.1 points

Strategic Implications for Retail Leaders

The Capability Imperative

The data is clear: retailers cannot staff their way back to traditional service models. Labor market dynamics, margin pressures, and customer expectations all point toward a necessary evolution in service delivery.

Winners will:

- View technology as capability amplifier, not staff replacement

- Invest in employee experience to retain best performers

- Design service models around customer need moments

- Measure outcomes (service quality, conversion, LTV) not inputs (labor cost %)

- Build competitive moats through superior service capability

Losers will:

- Continue cutting headcount to hit short-term targets

- Treat customer service as cost center to minimize

- Ignore technology transformation opportunities

- Experience death spiral of declining service, revenue, and capability

Investment Priorities by Company Size

Large Retailers ($1B+ revenue):

- Enterprise conversational AI across channels

- Unified customer data platform enabling personalization

- Workforce management optimization

- Live commerce and video shopping capabilities

- Advanced analytics for staffing and service optimization

Mid-Market Retailers ($100M-$1B revenue):

- Cloud-based customer engagement platform

- Conversational AI for common inquiries

- Live video shopping for high-value categories

- Mobile-enabled associate tools

- Integrated scheduling and demand forecasting

Small Retailers (<$100M revenue):

- Affordable conversational AI/chatbot solution

- Live video capabilities through platforms like Immerss

- Self-service tools (appointment booking, product lookup)

- Basic workforce scheduling optimization

- Customer feedback and measurement systems

Timeline and Implementation Approach

Phase 1 (0-6 months): Foundation

- Audit current service costs and gaps

- Evaluate technology solutions

- Pilot in 1-3 locations/channels

- Establish baseline metrics

Phase 2 (6-12 months): Validation

- Analyze pilot results

- Refine approach based on learnings

- Build business case for scale

- Begin broader deployment

Phase 3 (12-24 months): Scale

- Roll out proven solutions across organization

- Optimize based on accumulated data

- Evolve capabilities with new technology

- Achieve target service model

Conclusion: The Transformation Imperative

The Reddit discussion that sparked this analysis reflects a truth that industry data confirms: understaffing is not a sustainable strategy. The math doesn’t work. The human cost is unacceptable. The competitive consequences are severe.

But the solution isn’t simply more headcount. It’s smarter service delivery that combines human expertise with technological leverage.

The retailers who figure this out will deliver superior customer experiences at sustainable costs. Those who don’t will continue the decline that’s already evident across struggling segments of the industry.

The data points to a clear conclusion: transformation isn’t optional. The only question is timing. Early movers will establish advantages that late followers will struggle to overcome.

Explore how Immerss is helping retailers transform customer service economics through live commerce and AI-powered engagement.