When Product-Led Growth Meets Reality: The Atlassian Paradox Every SaaS Company Needs to Understand

The company that made “no sales team” sound brilliant just hired… a sales team.

Atlassian wore their lack of salespeople like a badge of honor for years.

No quotas. No cold calls. No LinkedIn spam.

Just pure product love driving them to $100M in revenue.

They were the platonic ideal of product-led growth—the company every SaaS founder pointed to when justifying their own anti-sales stance.

Then they hired Brian Duffy and built an enterprise sales team.

Oops.

Turns out even the most celebrated PLG darling eventually needs humans to close seven-figure deals.

Shocking development, truly.

I’m sure no one saw this coming except, well, literally everyone who’s ever tried to sell enterprise software.

But here’s what’s actually interesting: Atlassian didn’t fail. They evolved.

And understanding why matters enormously for anyone building conversational commerce, live shopping platforms, or any business trying to scale human connection.

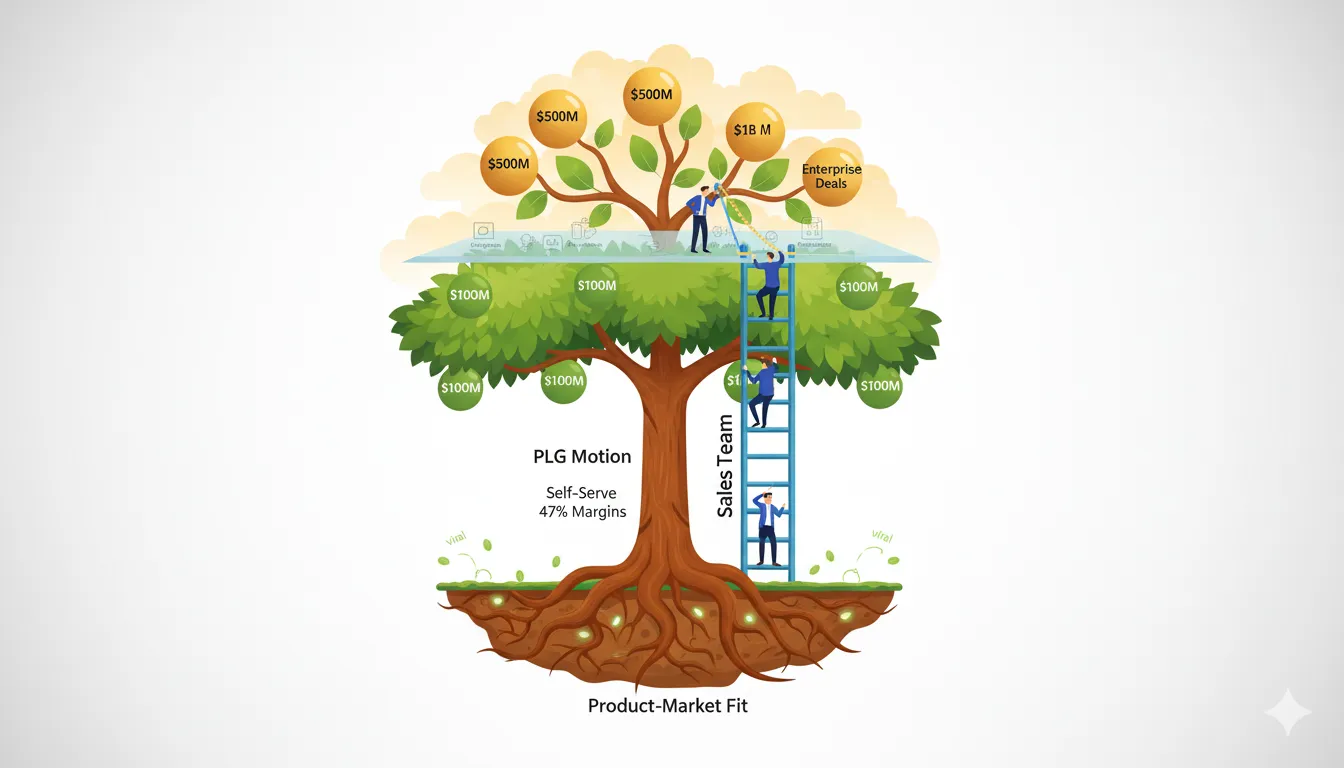

The Engine That Actually Worked (And Still Does)

Atlassian built something genuinely clever.

Jira doesn’t just manage projects—it emotionally manipulates you into collaboration.

Start a project solo and suddenly your PM is standing behind your desk asking why they can’t see the backlog.

Fire up a Confluence page and boom, everyone’s demanding editing access.

It’s peer pressure wrapped in productivity software.

And honestly? Kind of genius.

Their numbers back this up in ways that make traditional software vendors weep:

47% of revenue goes straight back into R&D while competitors torch 40%+ on quota-carrying reps who spend months convincing CTOs that yes, their software actually works.

The marketplace tells an even wilder story: $1.1 billion in third-party apps sold last year.

When your ecosystem generates that much revenue, you’ve basically created software quicksand—the deeper teams go, the harder it becomes to climb out.

This is product-led growth working exactly as promised:

- Viral adoption within organizations

- Self-serve revenue at scale

- Network effects that compound

- Ecosystem lock-in that’s voluntary

So why did they need sales?

When Reality Knocked

Enterprise buyers live in a parallel universe where “intuitive design” means nothing and “compliance audit trail” means everything.

Picture this:

Your CIO accidentally clicks into Jira and gets smacked with story points, epic burndowns, and sprint velocity charts.

To developers: beautiful complexity.

To enterprise buyers: incomprehensible chaos.

The disconnect is fundamental:

Product-led growth assumes:

- Users discover value organically

- Features sell themselves

- Adoption spreads virally

- Price point enables self-serve

Enterprise reality demands:

- Procurement committees with 8+ stakeholders

- Security compliance documentation (SOC 2, ISO 27001, GDPR)

- Integration with legacy systems nobody admits still exist

- Custom pricing negotiations

- Implementation roadmaps

- Executive sponsorship

- Risk mitigation frameworks

You can’t self-serve your way through that.

Not because the product isn’t good enough.

Because the buying process isn’t compatible with self-service.

The Seven-Figure Deal Problem

Here’s what Atlassian discovered (and what every PLG company eventually learns):

Deals under $10K: Product sells itself beautifully

Deals $10K-$50K: Product sells itself with some help (support team can handle)

Deals $50K-$100K: Product needs translation (specialized team required)

Deals $100K+: Product needs a human advocate inside the buyer’s organization

At enterprise scale, you’re not selling software.

You’re navigating organizational politics, mitigating perceived risk, and building consensus across departments that don’t talk to each other.

No product, no matter how good, does that by itself.

The Atlassian Pivot: Evolution, Not Failure

Here’s what’s critical to understand: Atlassian didn’t admit defeat.

They recognized market segmentation.

Their current model:

SMB/Mid-Market (under $50K):

- Pure product-led growth

- Self-serve onboarding

- Support-assisted expansion

- Viral adoption mechanics

- 47% margins maintained

Enterprise ($100K+):

- Sales-led but product-enabled

- Human navigation of procurement

- Custom implementation support

- Executive relationship building

- Lower margins but massive deal sizes

The genius: They didn’t abandon PLG. They augmented it.

The product still drives adoption within enterprises. Sales just helps enterprises buy what teams already want.

It’s not PLG vs. Sales.

It’s PLG for discovery, Sales for procurement.

The Live Commerce Parallel

This same pattern is playing out in conversational commerce and live shopping.

Pure self-serve works beautifully for:

- Impulse purchases

- Low-consideration items

- Repeat purchases

- Simple product selection

Human interaction becomes critical for:

- High-ticket items ($500+)

- Complex product selection

- First-time luxury purchases

- Customization decisions

Our data shows this clearly:

Products under $100:

- AI chatbot conversion: 12%

- Human-only conversion: 18%

- AI + Human hybrid: 28%

Products $500+:

- AI chatbot conversion: 4%

- Human-only conversion: 31%

- AI + Human hybrid: 43%

The pattern is identical to Atlassian’s discovery: past a certain complexity/value threshold, humans aren’t nice-to-have. They’re essential.

Why “Product-Led” Became Religion

The PLG movement emerged from real frustrations with traditional enterprise software sales:

Traditional Enterprise Sales:

- 6-18 month sales cycles

- Armies of expensive reps

- Relationship-dependent deals

- Opaque pricing

- Demo theater

- Vaporware promises

Product-Led Growth promised:

- Try before you buy

- Value discovery through use

- Transparent pricing

- Self-serve at scale

- Product quality as differentiation

And for a huge market segment, this works perfectly.

But like all religions, PLG developed fundamentalist branches that rejected nuance.

“Sales teams are evil” became dogma.

“If you need sales, your product isn’t good enough” became scripture.

Atlassian’s evolution breaks this false dichotomy.

The Real Lesson: Match Motion to Market

The insight isn’t “PLG failed” or “Sales won.”

The insight is: different market segments require different go-to-market motions.

For Atlassian (and most SaaS):

SMB segment:

- Self-serve discovery

- Product-led growth

- Support-assisted expansion

- Community-driven adoption

Enterprise segment:

- Product-enabled discovery (teams still find it organically)

- Sales-assisted procurement (humans navigate buying process)

- Implementation-supported rollout

- Account management for expansion

For Live Commerce:

Impulse/Low-Consideration:

- AI-powered instant responses

- Frictionless checkout

- Automated recommendations

- Self-serve experience

Consultative/High-Value:

- Human expertise on demand

- Real-time consultation

- Relationship building

- Guided discovery

The pattern: let product/AI handle what they handle well, bring in humans for what requires judgment, relationship, or navigation of complexity.

What Atlassian Got Right (That Others Miss)

Most companies facing Atlassian’s challenge make one of two mistakes:

Mistake 1: Add sales too early

- Kills PLG motion before it proves out

- Sales becomes crutch instead of accelerant

- Loses efficiency advantages

- Never develops product-market fit

Mistake 2: Resist sales too long

- Leaves enterprise revenue on table

- Competitors with sales teams win deals

- Product limitations blamed instead of GTM mismatch

- Growth stalls despite product excellence

Atlassian’s timing was nearly perfect:

- Built undeniable product-market fit in SMB (0-$100M)

- Proved PLG efficiency at scale ($100M-$1B)

- Hit enterprise ceiling organically (teams loved product, procurement hated process)

- Added sales to unlock next phase ($1B+)

They didn’t abandon what worked.

They added what was missing.

The Metrics That Matter

How do you know when you need the Atlassian pivot?

Watch these signals:

Product-led metrics plateauing:

- Organic sign-up growth slowing

- Trial-to-paid conversion flattening

- Expansion revenue stalling

- Larger deals not closing

Enterprise signals appearing:

- RFPs you can’t respond to

- Security questionnaires you can’t complete

- Procurement processes you can’t navigate

- Implementation requirements you can’t support

Competitive pressure:

- Sales-enabled competitors winning despite inferior product

- “We love the product but can’t get it approved” feedback

- Deals lost to “nobody gets fired for buying [competitor]”

At this point, sales isn’t admitting defeat. It’s unlocking growth.

The AI + Human Parallel Is Exact

The Atlassian story is playing out identically in AI customer engagement:

Early AI enthusiasm: “We’ll automate everything! No humans needed!”

Reality check: “Customers hate our bot and churn is spiking”

Mature approach: “AI handles qualification and routing, humans handle consultation and relationship”

The result: 2-3x better outcomes than either alone.

Just like Atlassian discovered:

- PLG alone: great for SMB, hits ceiling

- Sales alone: expensive, slow, doesn’t scale

- PLG + Sales: unlocks full market

For conversational commerce:

- AI alone: efficient but low conversion on complex/high-value

- Humans alone: high conversion but doesn’t scale

- AI + Human: scalable AND high conversion

The winning pattern is the same: use each approach where it has advantage, combine for leverage.

What This Means for Your Business

If you’re building anything that involves customer interaction:

Ask yourself:

1. What can genuinely self-serve?

- Simple transactions

- Repeat purchases

- Low-consideration decisions

- Straightforward use cases

Let product/AI handle this without friction.

2. What requires human judgment?

- Complex decisions

- High-value transactions

- Risk mitigation

- Relationship building

Bring humans in strategically here.

3. Where does the transition happen?

- Dollar value threshold?

- Complexity threshold?

- Stakeholder count threshold?

- Time-in-process threshold?

Design the handoff intentionally.

The Atlassian Lesson

Atlassian didn’t betray product-led growth by hiring sales.

They graduated to product-led growth + sales-assisted procurement.

The product still drives adoption.

Sales just helps enterprises navigate their own buying process.

It’s not ideology.

It’s market segmentation.

Different buyers have different buying processes.

Meet them where they are, not where your go-to-market religion says they should be.

For live shopping and conversational commerce, the lesson is identical:

Use AI for efficiency where efficiency drives value.

Use humans for connection where connection drives value.

Use both where combination creates leverage.

The companies achieving 28% conversion rates (vs 2% traditional ecommerce) aren’t doing it through AI alone or humans alone.

They’re doing it through intelligent orchestration of both.

Just like Atlassian is achieving $1B+ revenue through intelligent orchestration of product-led growth and sales-assisted enterprise.

The future isn’t choosing between automation and human touch.

The future is knowing when to use which.

The question for your business: Where are you forcing self-serve when humans would unlock growth? Where are you using humans when automation would increase efficiency?

Atlassian figured it out at $1B revenue. You can figure it out now.

At Immerss.live, we’ve built this orchestration into our platform—AI identifies intent and opportunity, humans provide expertise and connection, together they deliver 28% conversion rates. Because the future isn’t AI vs. Humans. It’s AI + Humans, intelligently combined.