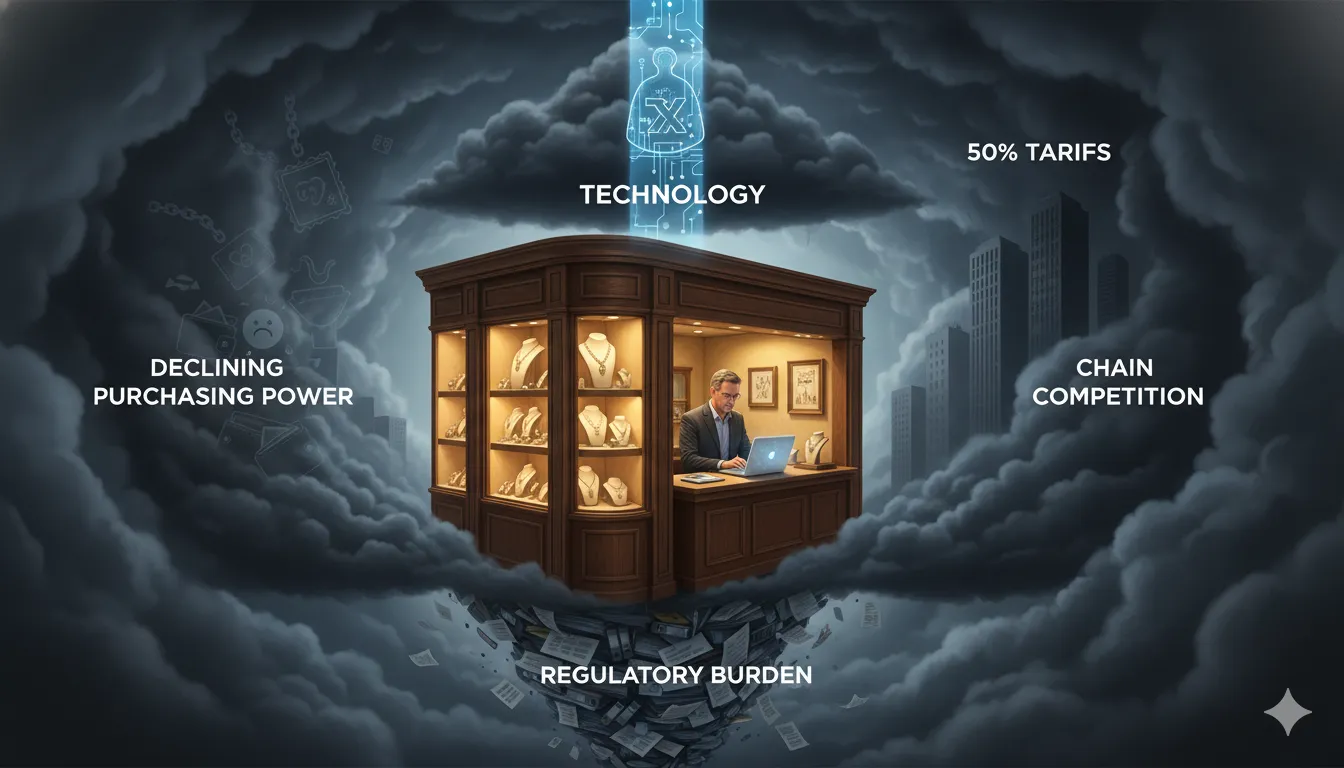

The Perfect Storm: How Jewelry Retailers Can Survive (and Thrive) in 2025’s Most Challenging Market

The jewelry retail industry is facing an unprecedented convergence of challenges in 2025. Declining consumer purchasing power, aggressive chain expansion, crushing tariffs, and regulatory complexity are creating what industry insiders are calling “the perfect storm”—a combination of pressures that’s forcing small and medium retailers to either radically transform or close their doors.

But here’s what the doom-and-gloom headlines miss: the retailers who survive this storm won’t just survive—they’ll emerge stronger, with competitive advantages their predecessors never imagined.

This isn’t optimistic speculation. It’s what we’re already seeing from jewelers who recognized the crisis early and adapted strategically rather than reactively.

The four horsemen of jewelry retail apocalypse

Let’s be brutally honest about what’s happening. The challenges facing jewelry retailers aren’t temporary market corrections—they’re fundamental structural shifts that demand equally fundamental responses.

1. Purchasing power collapse crushing mid-market demand

Consumer spending on jewelry has entered a sustained decline, particularly in the mass and mid-market segments where most independent jewelers compete.

The data tells the story:

- Real wages stagnant while inflation erodes purchasing power

- Discretionary spending shifting toward experiences over goods

- Economic uncertainty making luxury purchases feel risky

- Mid-market customers (the $500-$5,000 jewelry buyer) disappearing fastest

For jewelry retailers, this isn’t just about selling less. It’s about the core customer segment vanishing entirely.

The customer who used to browse for a $2,000 anniversary gift now thinks twice about $500. The couple who budgeted $8,000 for an engagement ring is now looking at $4,000 alternatives—or lab-grown diamonds at half that price.

This creates an impossible squeeze: You can’t move upmarket (ultra-luxury is dominated by established brands), you can’t move downmarket (chains and online sellers own that space), and your traditional mid-market is evaporating.

2. Chain consolidation accelerating the competitive gap

While independent jewelers struggle with declining demand, large chains are aggressively expanding—and the resource gap is widening at an accelerating pace.

What chains bring to the fight:

Marketing budgets: $500K-$2M annually per market vs. $10-20K for independents

- Omnipresent Instagram and Google ads

- Influencer partnerships and celebrity endorsements

- Sophisticated retargeting and customer acquisition funnels

- Brand awareness that drives consideration before customers ever shop

Technology investments: $2M-$10M in digital infrastructure

- Custom mobile apps with AR try-ons

- Sophisticated CRM systems tracking customer journeys

- Omnichannel inventory visibility

- AI-powered personalization engines

- Virtual consultation capabilities

Operational advantages:

- Negotiate 20-30% better pricing on inventory due to volume

- Absorb market downturns across multiple locations

- Test new concepts in select markets before scaling

- Data from thousands of transactions informing strategy

Expansion capital:

- Opening new locations while independents close

- Strategic acquisitions of struggling competitors

- Prime real estate access through corporate backing

The result? Small and medium jewelry stores are closing at accelerating rates. The survivors face an existential question: how do you compete when the resource gap is this wide?

3. Tariff shock destroying profit margins

The 50% tariff on Indian diamonds—which supply 90% of the world’s polished diamonds—has fundamentally broken jewelry economics for small retailers.

The math that doesn’t work anymore:

Before tariffs:

- Diamond wholesale cost: $1,000

- Retail price: $2,000 (100% markup)

- Gross profit: $1,000

- Gross margin: 50%

- Operating expenses: $600

- Net profit: $400 (20% net margin)

After 50% tariffs:

- Diamond wholesale cost: $1,500 (+50% tariff)

- Market retail price: $2,000 (customers won’t pay more)

- Gross profit: $500

- Gross margin: 25% (cut in half)

- Operating expenses: $600 (unchanged)

- Net profit: -$100 (20% loss on every sale)

You literally cannot sell diamonds profitably at previous retail prices, but raising prices drives customers to alternatives.

The scramble for alternatives isn’t working:

Jewelers are desperately seeking non-Indian diamond sources:

- China: Quality inconsistent, ethical concerns damaging brand

- Turkey: Limited supply, can’t meet volume needs, higher base prices

- Mexico: Small-scale operations, logistics challenges

- Lab-grown diamonds: Margins even worse, cannibalize natural diamond sales

The brutal reality: Alternative sources often cost the same or more once you factor in quality control, logistics, and the risk of returns. The tariff didn’t just increase costs—it eliminated viable margins on diamond jewelry entirely.

For a small jeweler doing $1M annually in diamond sales, the tariff just erased $200-300K in gross profit. That’s not a line-item problem. That’s an existential crisis.

4. Regulatory complexity strangling operations

Financial compliance and regulatory oversight have intensified dramatically, particularly for small retailers operating multiple locations or using independent contractor structures.

The compliance burden:

Financial transaction monitoring:

- Enhanced due diligence on cash transactions over $10,000

- Suspicious Activity Report (SAR) filing requirements

- Customer identification and verification protocols

- Record-keeping spanning 5+ years

Multi-location complexity:

- Each location treated as separate entity for reporting

- Inconsistent local regulations across jurisdictions

- Independent contractor (1099) structures now heavily scrutinized

- IRS and state tax authority audits increasing

The hidden costs:

- Legal compliance: $15,000-$50,000 annually for small multi-location retailers

- Accounting and bookkeeping: Additional $10,000-$30,000 annually

- Staff training on compliance: Ongoing time and money

- System upgrades for tracking and reporting: $5,000-$20,000

- Lost productivity: Owners spending 10-20 hours weekly on compliance

For context: A three-location jewelry retailer might face $50,000-$100,000 in annual compliance costs that didn’t exist five years ago. On already-compressed margins, this administrative burden alone can determine whether the business survives.

Why conventional survival strategies fail

Faced with these challenges, most jewelers default to predictable responses. Unfortunately, these “obvious” strategies often accelerate failure rather than prevent it.

Strategy 1: Cut costs and wait it out

The logic: “Margins are compressed, so we’ll reduce expenses and ride out the downturn.”

Why it fails:

- Cutting staff reduces customer service quality, driving more customers to chains

- Reducing inventory selection gives customers fewer reasons to visit

- Deferring maintenance makes stores feel dated and uninviting

- Marketing cuts make you invisible when customers do have money to spend

- You’re optimizing for survival, not competitiveness

Cost-cutting rarely returns businesses to growth. It just slows the decline.

Strategy 2: Compete on price

The logic: “If customers have less money, we’ll offer deeper discounts.”

Why it fails:

- Chains have better cost structures and can always go lower

- Online sellers have no overhead and undercut everyone

- Discounting trains customers to wait for sales, destroying full-price business

- Margins are already crushed—discounting accelerates profit death

- You’re competing on the dimension where you’re weakest

Price wars favor the largest player. Small jewelers can’t win this battle.

Strategy 3: Double down on traditional differentiation

The logic: “We’ll emphasize our personal service and local community connection.”

Why it fails:

- Personal service doesn’t matter if customers never walk through your door

- “Shop local” appeals work on margins, not when the price gap is substantial

- Younger customers (your future) don’t have the same community loyalty

- Traditional foot traffic continues declining regardless of service quality

- You’re optimizing for customers who are disappearing

What worked in 2010 doesn’t work in 2025. The customer base and shopping behaviors have fundamentally changed.

Strategy 4: Move upmarket to ultra-luxury

The logic: “We’ll focus on high-margin, affluent customers less affected by economic pressures.”

Why it fails:

- Ultra-luxury is dominated by established brands (Tiffany, Cartier, Harry Winston)

- Wealthy customers already have trusted luxury sources

- Moving upmarket requires inventory investment you can’t afford

- Your brand positioning doesn’t support $50K+ purchases

- You’re entering the most competitive segment with the weakest position

Ultra-luxury is winner-take-all. Without decades of brand building, you can’t compete.

The strategic insight everyone’s missing

Here’s what the surviving jewelers figured out early: You’re not competing for the same customer in the same way anymore.

The customer journey has fundamentally changed:

Old journey (2010-2020):

- Customer decides they want jewelry

- Customer visits stores in their area

- Customer compares options in-person

- Customer makes purchase decision

- Relationships built through repeated in-store visits

New journey (2025):

- Customer researches online (often for weeks)

- Customer narrows options through reviews, comparisons, social media

- Customer has specific questions but no one to ask

- Customer either: (a) buys online from whoever has best info, or (b) abandons because too much uncertainty

- Physical store visits happen only after 80% of decision already made

The insight: Customers aren’t avoiding jewelry because they don’t want it. They’re avoiding purchase because the research-to-decision journey has too much friction and uncertainty.

Traditional jewelers say: “Come to our store and we’ll help you.”

Customers think: “I’m not driving 30 minutes to a store when I’m just researching and might not buy anything.”

The gap between these positions is where conversions die.

The technology solution nobody’s implementing (but should be)

The jewelers thriving through this crisis made a counterintuitive strategic bet: instead of cutting costs, they invested in technology that closes the research-to-purchase gap.

Specifically, live shopping and conversational commerce platforms that let them deliver their expertise to customers exactly when and where they’re researching—which is online, at 10 PM on a Tuesday, in their pajamas.

What this looks like in practice

Traditional scenario:

- Customer researches engagement rings online for 2 weeks

- Visits 3-4 websites, reads reviews, watches videos

- Has questions about diamond quality, metal options, sizing

- Eventually either: (a) buys from whoever had best information, even if not best price, or (b) abandons due to uncertainty

- Independent jeweler with superior expertise and selection never even enters consideration

Live shopping scenario:

- Customer researching engagement rings on your website at 9 PM

- Small prompt appears: “Questions about diamonds? Talk to our gemologist now”

- Customer clicks, connects via video with your expert immediately

- Expert asks about preferences, explains diamond quality in simple terms

- Shows multiple options under proper lighting

- Discusses budget, compares options, addresses concerns

- Customer completes $6,500 purchase that same evening

- Total time: 35 minutes from first click to completed sale

The difference: You converted a researcher into a buyer by being available exactly when they needed expertise.

Why this works when other strategies fail

It addresses all four crisis factors simultaneously:

1. Declining purchasing power: When customers have less to spend, they need MORE confidence they’re making the right choice, not less. Expert guidance at the moment of decision increases conversion and reduces returns (which destroy margin).

2. Chain competition: Chains have standardized service and high employee turnover. A 23-year-old working their retail shift can’t compete with your 40 years of expertise—but only if customers can access that expertise. Live shopping scales your personal advantage to match chains’ reach.

3. Tariff-crushed margins: When profit per item drops 50%, you need to sell more and waste less. Live consultations increase average order value 40-60% through personalized recommendations and reduce returns by 30% because customers buy the right product the first time.

4. Operational complexity: Digital consultations generate automatic records, create defensible transaction documentation, and reduce the compliance burden of unclear cash transactions. Plus, one expert can serve customers globally from a single location, reducing multi-location complexity.

The results that prove it works

These aren’t hypothetical benefits. They’re actual results from jewelers who implemented live shopping over the past 18 months:

Independent jeweler, Texas (competing with 3 major chains):

- Added live shopping capability

- Dubai customer: $8,000 engagement ring via video consultation

- Seattle bride: Custom wedding set after 45-minute virtual appointment

- Chicago couple: Diamond education and purchase at 10 PM their time

- New digital revenue in 3 months: $127,000

- Average order value increase: 62%

- Return rate: Dropped from 18% to 11%

Family jewelry business, Florida (50-year-old store facing closure):

- Implemented virtual consultations alongside in-store

- Customers in 12 states within first 6 months

- Average consultation length: 28 minutes

- Consultation-to-purchase conversion: 34%

- Total new revenue: $243,000 annually

- Avoided closure, now expanding digital capability

Multi-location jeweler, California (margins destroyed by tariffs):

- Used live shopping to increase AOV and reduce returns

- AOV increased 57% through expert recommendations

- Return rate decreased 31% through better initial selection

- Net effect: Restored profitability despite tariff impact

- Now closing unprofitable locations but growing digital revenue

The pattern repeats: Jewelers who invested in conversational commerce during this crisis are thriving. Those who waited or cut costs are closing.

The implementation reality (simpler than you think)

Most jewelers hear “technology investment” and think “six-figure budgets, months of implementation, IT complexity.”

The reality is dramatically simpler:

Week 1-2: Integration

- Platform connects to your existing website/e-commerce

- Works with Shopify, WooCommerce, custom sites

- No rebuilding required—adds capability to what you have

- Technical setup handled by platform provider

Week 3: Training

- Your team (or just you) learns how to conduct video consultations

- Practice showing jewelry under proper lighting

- Develop talking points for common questions

- Test with friends/family to refine approach

Week 4: Launch

- Go live with subtle prompts on product pages

- “Questions about this piece? Talk to our expert”

- Start with limited hours, expand as you gain confidence

- Monitor what questions customers ask, refine responses

Month 2-3: Optimization

- Analyze which triggers work best (time on page, scroll depth, etc.)

- Refine consultation approach based on what converts

- Expand availability (or add AI assistance for off-hours)

- Scale what works, eliminate what doesn’t

Investment: Typically $2,000-$5,000 monthly for full-service platform. Significantly less than the profit lost from a single closure-threatened location.

ROI: Most jewelers see positive ROI within 60-90 days as digital consultations begin converting browsers into buyers.

What makes this different from “just having a website”

Every jeweler has a website. Most have e-commerce. Very few have conversational commerce. The difference is critical:

Traditional e-commerce:

- Customer browses products alone

- Reads descriptions, looks at photos

- Has questions, can’t get answers

- Either buys (rarely) or leaves (usually)

- Conversion rate: 1-3%

Conversational commerce:

- Customer browses products

- Small prompt offers expert help

- Customer connects instantly via video or chat

- Expert answers questions, demonstrates products, builds confidence

- Customer buys with certainty

- Conversion rate: 25-35% of engaged customers

The math: If 1,000 people visit your site monthly:

- Traditional e-commerce: 10-30 sales

- Conversational commerce (25% engagement, 30% conversion): 75 sales

- 2.5-7.5x more revenue from identical traffic

This isn’t incremental improvement. It’s business model transformation.

The psychological barrier (and why you need to overcome it)

I’ve had this conversation with dozens of jewelers over the past year:

Jeweler: “Our customers prefer the in-store experience. They want to touch and see the jewelry in person. Video consultations won’t work for us.”

Reality check: Your customers are already researching online. They’re already making 80% of their decision digitally. They’re just buying from whoever provides the best information during that research phase.

When you say “customers prefer in-store,” what you mean is “our current customers who complete purchases prefer in-store.”

But what about the 98% who research and never buy? What about the customer in the next state over who would love your expertise but will never drive 3 hours to your store? What about the late-night researcher with questions who gives up and buys from the site that had a 24/7 chatbot?

The insight: You’re optimizing for the 2% who convert traditionally while ignoring the 98% who would convert with different engagement.

Live shopping isn’t about replacing in-store. It’s about capturing the massive market of customers who want expertise but can’t or won’t visit physical locations during your business hours.

The competitive timing advantage (closing fast)

Here’s why timing matters more than usual: This technology is new enough that most jewelers don’t have it, but mature enough that implementation is simple.

The current market:

- Large chains are aware but moving slowly (enterprise decisions take 12-18 months)

- Online pure-plays are adding it but lack personal expertise to leverage it

- Most independent jewelers don’t know it exists or think it’s too complex

- Early adopters are capturing disproportionate advantage

What happens in 12-24 months:

- Chains complete implementations, bring resources to bear

- Industry publications cover it, everyone becomes aware

- Being conversational-commerce-enabled becomes table stakes, not differentiator

- First-mover advantage disappears

The window: Right now, a mid-size jeweler with conversational commerce capability has a genuine competitive advantage over both chains (too slow) and other independents (unaware).

In 24 months, everyone will have it. But the jewelers who built expertise, customer bases, and brand recognition as “the jeweler who does virtual consultations” will own that market.

First movers win disproportionately in platform shifts. This is a platform shift.

The path forward for different jeweler types

Not every jeweler faces identical pressures or has identical options. Here’s how different types should think about navigating this crisis:

Single-location independent jeweler

Your advantages: Deep expertise, personal relationships, flexibility Your challenges: Limited resources, competing with chains, shrinking local market

Strategic focus:

- Use live shopping to break free of geographic limitations

- One location can serve customers nationally/globally

- Your expertise is your moat—scale it digitally

- Start with your existing customer base (they already trust you)

- Expand to new markets where your expertise fills gaps

ROI timeline: 60-90 days to positive returns as you convert previously lost web traffic

Multi-location regional jeweler

Your advantages: Established brand, multiple markets, some scale Your challenges: Operational complexity, margin compression across all locations, chains targeting your markets

Strategic focus:

- Consolidate expertise across locations via digital

- Close unprofitable physical locations, serve those markets digitally

- Use live shopping to test new markets before committing to leases

- Leverage existing brand recognition to drive digital traffic

- Transform underperforming locations into digital consultation hubs

ROI timeline: 3-6 months as you optimize location mix and increase digital contribution

Family jewelry business (multi-generational)

Your advantages: Reputation, long-term customer relationships, deep market knowledge Your challenges: Traditional mindset, limited digital capability, next-generation sustainability

Strategic focus:

- Bridge traditional values with digital capability

- Your reputation is your greatest asset—make it accessible beyond your physical reach

- Use live shopping to engage next generation while maintaining core values

- Position digital transformation as preserving family legacy, not abandoning it

- Create succession path that includes digital leadership

ROI timeline: 6-12 months as you build digital capability while maintaining traditional strengths

What this means for the industry long-term

The jewelry retail industry is undergoing forced evolution. The perfect storm of declining purchasing power, chain consolidation, tariff shock, and regulatory complexity is accelerating a transformation that was already inevitable.

The survivors won’t be the biggest. They’ll be the most adaptable.

Specifically, they’ll be jewelers who:

- Recognized that customer behavior has permanently changed

- Invested in technology that scales personal expertise

- Focused on conversion optimization, not just traffic generation

- Built businesses around accessibility and expertise, not just location

- Adapted faster than chains while maintaining superior service

Five years from now, the industry will have two types of jewelry retailers:

Type 1: Consolidated corporate chains

- Standardized service across hundreds of locations

- Heavy investment in brand and marketing

- Competing on convenience and price

- Low-margin, high-volume business model

Type 2: Expert-driven independents with digital reach

- Personal expertise delivered at scale through technology

- Premium positioning based on knowledge and service

- Competing on expertise and relationship

- Higher-margin, relationship-based business model

Type 3 (extinct): Traditional local jewelers

- Location-dependent business model

- Unable to reach beyond geographic boundaries

- Crushed between chain competition and digital transformation

- Couldn’t or wouldn’t adapt

The question facing every jeweler reading this: Which type will you be?

The decision in front of you right now

If you’re a jewelry retailer facing these challenges—and if you’re still in business, you are—you have a choice to make.

Option 1: Continue current path

- Hope the market improves

- Continue losing customers to chains and online

- Watch margins compress further

- Eventually close or sell at distressed valuation

Option 2: Adapt strategically

- Invest in conversational commerce technology

- Scale your expertise to match chain reach

- Capture the massive market researching online

- Build sustainable competitive advantage

The brutal honesty: Option 1 is slow decline. The market conditions that created this perfect storm aren’t temporary. They’re the new permanent reality.

The opportunity: Option 2 isn’t just survival—it’s positioning for long-term competitive advantage while most of your competitors either ignore the shift or move too slowly.

Bottom line

The jewelry retail crisis of 2025 is real and severe. Declining purchasing power, chain consolidation, crushing tariffs, and regulatory complexity are forcing thousands of small and medium jewelers toward closure.

But crisis creates opportunity for those who move decisively.

The jewelers thriving through this period made a counterintuitive bet: instead of cutting costs and hoping for recovery, they invested in technology that scales their core advantage—expertise—to meet customers exactly where they’re making decisions.

Live shopping and conversational commerce platforms let you deliver personal consultations to customers globally, at any time, without the overhead of physical expansion. You can compete with chains’ reach while maintaining superior expertise. You can increase average order values and reduce returns despite compressed margins. You can serve customers across state lines from a single location, reducing regulatory complexity.

Most importantly, you can convert the 98% of web visitors who research but never buy because they can’t access expertise at the moment they need it.

The technology exists. The business model works. The results are proven.

The only question is whether you’ll implement before your competitor does—or before you’re forced to close.

The perfect storm is here. The survivors won’t be the ones who waited it out. They’ll be the ones who adapted fastest.

At Immerss, we’ve helped jewelry retailers navigate this exact crisis by implementing live shopping and conversational commerce that turns researchers into buyers. If you’re facing these challenges and want to explore how technology can create competitive advantage instead of just adding costs, let’s talk. The consultation is free. The insights might save your business.